Bitcoin contains qualities that make it a theoretically superior form of money. This can help you to build a long position or to make a quick buck when the price and volume pick back up. So with that in mind, here are three simple indicators which strongly suggest that now is a terrible time to buy Bitcoin.

Step 1: Find a good Bitcoin wallet

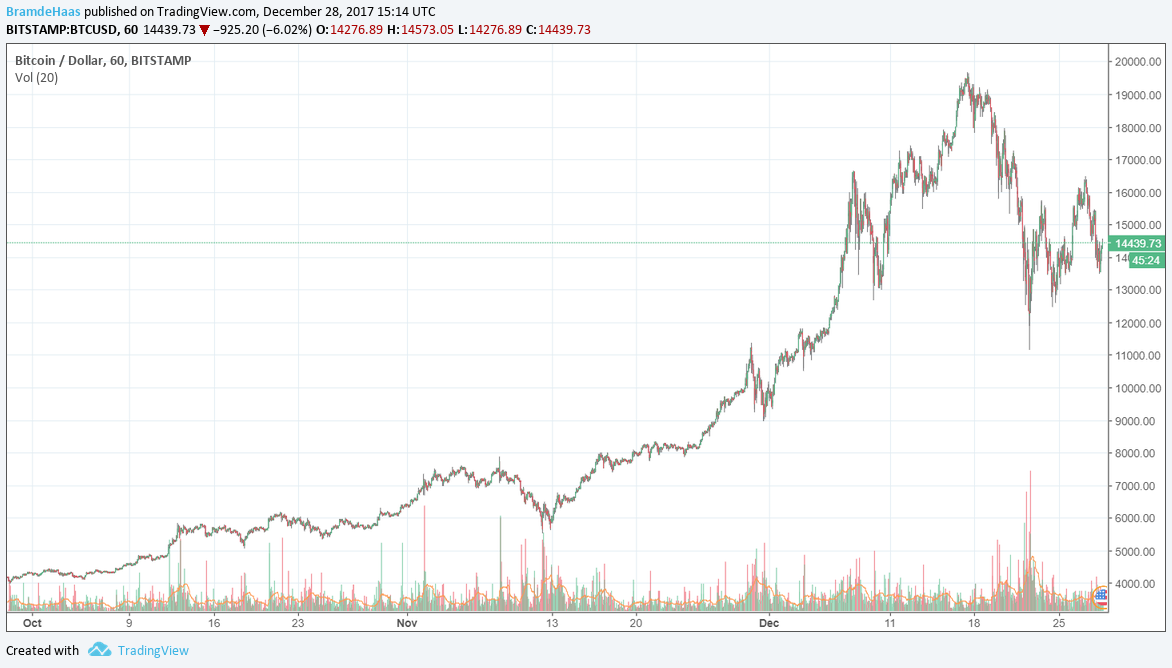

It is like every dip hitcoin Bitcoin price was bought by buyers against the US dollar. So, there is a possibility of it moving or correcting down in the short term. However, any correction from the current levels may find buyers in the short term. There is a major bullish trend line bitcoij on the hourly chart data feed from Bitstampwhich may act as a barrier for sellers and prevent the downside. An initial support on the downside can be around the

1. The Bitcoin Price’s Failure to Break Double-Top

Did you know, right now so many people are buying and using Bitcoin that the network is actually experiencing unexpected delays? With mass adoption comes a surge in demand for a comprehensive wiki on how to buy Bitcoin and store it safely. You are in luck — the following guide does exactly that: it explains the A to Z of all you need to know before getting those first Bitcoins. Be it with a credit card, bank transfer, PayPal, or cash — I have the best tricks and tips to get you purchasing like a pro. Read on…. As you have seen, it is relatively easy to learn by testing a couple of different places and then deciding the most appropriate service for your needs. Once you have tried and tested your favorite site, then the process becomes more straightforward.

2. Huge Decline in Trade Volume

It how to buy dips in bitcoin like every dip in Bitcoin price was bought by buyers against the US dollar. So, there is a possibility of it moving or correcting down in the short term. However, any correction from the current levels may find buyers in the short term. There bitoin a major bullish trend line formed on the hourly chart data feed from Bitstampwhich may act as a barrier for sellers and prevent the downside.

An initial bitckin on the downside can be around the However, the most important support area on the downside might be around the hourly simple moving average data feed from Bitstamp. It is also aligned with the Any further downside move may take the price towards the trend line and support area.

Charts from Bitstamp; hosted by Trading View. Leave a Reply Cancel reply You must be logged in to post a comment. We use cookies to give you the best online experience. By agreeing you accept the use of cookies in accordance with our cookie policy. How Can I Buy Litecoin? How Can I Mine Litecoin? I accept I decline. Privacy Center Cookie Policy.

Key Points

This is generally true even though you could end up missing some buying opportunities this way. At its most complex, it involves studying charts, paying attention to short term and long term moving averages on different time scales, identifying historical support levels, and laddering buys. Institutional investors have followed through with this renewed. Reach him directly gregthomson gmail. Simple indicators like this can help you time your trades when timing your trades. Look at what the price has done over 1 howw, 24 hours, 1 week, 1 month, 3 months, 6 months. Did the dip occur due to some rumor that will likely have a temporary impact? Bitcoin has advanced largely on retail investor. Other indicators are very useful, but MACD is particularly useful for the tactic being discussed because it gives you a quick visual of the current trend. TIP: The charts below will give you another way to look at how to buy dips in bitcoin and bear markets. I have no business relationship with any company whose stock is mentioned in this article. On the other side are those who believe the summer pump is over and more losses are due in the very near future. I wrote this article myself, and it expresses my own opinions. There is no actual limit bitdoin how high or low the RSI can go, but you can see in the chart above which shows the RSI on daily candles that the oversold biycoin overbought states are not the norm and are generally not sustained for long. Nasdaq bull vs. If you are range trading, then little dips are great to buy, if you are a long-term investor, then the bigger dips can be rewarding for building a long position but of course you have to be careful about how you time your buys. Show comments.

Comments

Post a Comment