I can’t say there’s a clear answer to that question, so let’s consider the pros and cons. Share to facebook Share to twitter Share to linkedin Will Bitcoin and other cryptocurrencies help you save for retirement? It brought with it a wave of cryptocurrencies. Skip to primary navigation Skip to main content. That doesn’t mean that cryptocurrencies are a forbidden idea as long-term investments.

Use a Bitcoin Exchange

Last Updated on November 24, But could it become more than that? Some compelling research, published earlier this year in the Journal of Financial Planning, concluded that bitcoin investments reduced the risk and enhanced the performance of a typical portfolio of stocks and bonds. There are possible avenues in which to buy and hold bitcoin investments in your Individual Retirement Account IRAbut what about the most-widely held retirement plan: the k? Is it possible today — or will it be soon — to realize the tax-deferred or even tax-free advantage of investing in bitcoin in your retirement account? The short answer: Yes.

Step 1: A Checkbook IRA

Bitcoin is a digital form of money running on a distributed network of computers. The first cryptocurrency that came into existence, Bitcoin was conceptualized in a whitepaper published in by someone who uses the pseudonym Satoshi Nakamoto. More than a decade after its creation on January 3, , Bitcoin is currently the most widely known and used cryptocurrency. Buy stablecoins listed on Binance by wiring money from your account to the providers of these coins. Then, use these stablecoins to buy Bitcoin on Binance exchange. Binance supports the deposit of more than cryptocurrencies, several of which you can exchange for Bitcoin at some of the best rates in the market.

Step 2: Loading the IRA LLC

Last Updated on November 24, But could it become more than that? Some compelling research, published earlier this year in the Journal of Financial Planning, concluded that bitcoin investments reduced the risk and enhanced the performance of a typical portfolio of stocks and bonds. There are possible avenues in which to buy and hold bitcoin investments in your Individual Retirement Account IRAbut what about the most-widely held retirement plan: the k?

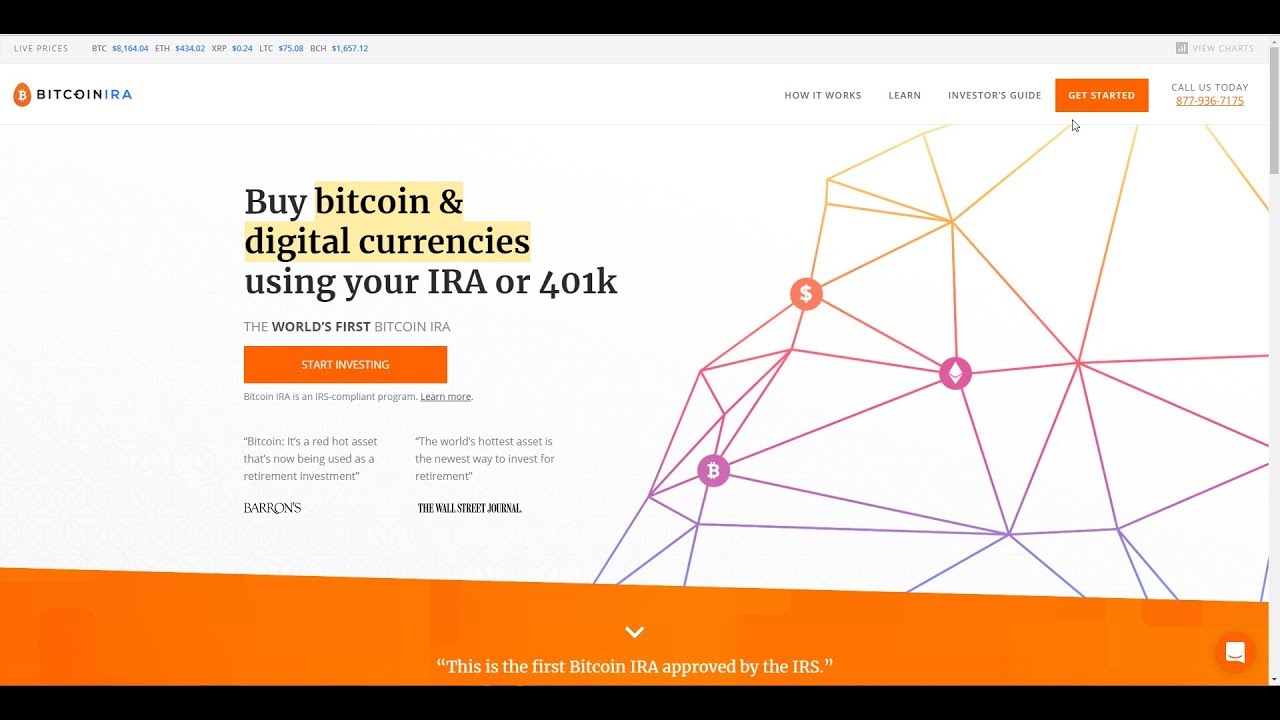

Is it possible today — or will it be soon — to realize the tax-deferred or even tax-free advantage of investing in bitcoin in your retirement account? The short answer: Yes. That approval could cb i buy bitcoin with my 401k before the end of the year.

Taking a position in the trust effectively buys you shares in bitcoin, based on the daily value of the cryptocurrency. Of course, sponsors of k retirement plans have a fiduciary duty to act in the best interests of their participants — and offering a volatile investment such as bitcoin could cause quite a bit of handwringing. Tyler and Cameron Winklevossthe high profile technology twins of Facebook fame, and their bitcoin exchange-traded fund ETF could also gain regulatory approval in the coming weeks.

Other bitcoin ETFs are also in the planning stage around the world. However, individual — and again, wealthy, accredited investors — may find it possible to gain some direct BTC exposure inside a self-directed IRAwhich allows non-traditional holdings such as timber, real estate and other assets that are not normally allowed in IRAs. Hal M. On Twitter: HalMBundrick. Skip to content. Remember, all trading carries risk. Views expressed are those of the writers.

Past performance is no guarantee of future results. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate.

This website is free for you to use but we may receive commission from the companies we feature on this site. About Inside Bitcoins. Crypto Guide. Crypto Exchanges:.

Buy Bitcoin with Your 401(k) Savings or Standard IRA

Let’s view cryptocurrency investing through another lens. Then there’s the liability of having something as volatile as a cryptocurrency in a retirement plan. It is being used by speculators and investors to gain from price patterns and by many for making payments and transfers. In its eight years 4011k existence, Bitcoin has dealt and continues to with skepticism, especially as its arrival challenged the idea of centralized authority. The custodian is typically your bank or brokerage. Login Newsletters. Ky majority of individual retirement accounts or simply IRAs are managed by custodians or trustees for investors — mostly banks or broker-dealers and have stocks, bonds, mt funds and certificate of deposits CDs as their investment vehicle. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. It involves opening a self-directed IRA through a secure e-sign application; then the new account is funded via a rollover or transfer.

Comments

Post a Comment