Join Benzinga’s Financial Newsletter. From online seminars for new traders to the My Virtual Advisor retirement planning tool, E-Trade will help traders invest their money competently and confidently every step of the way. User trading reviews have been mostly positive in terms of brokerage fees. Having said that, Etrade does try and encourage users to find their own answers by heading over to their FAQ page.

CFD trading steps

View more search results. This guide shows you how to trade CFDs step-by-step, from opening an account to closing a position, and illustrates the process with example CFD trades. When you trade CFDs contracts for differenceyou buy a certain number of contracts on a market if you expect its price to rise, and sell them if you expect it to fall. Dos the finer details can often be a little coat complicated — especially since platforms and functionality vary from provider to provider. The first step towards trading CFDs is to learn how they work.

Need a better alternative?

If the trade on eBay is between buyers and sellers, how does eBay itself make money? There must be a catch somewhere! That’s not the case at all. Let’s break it down. There is no monthly fee to be a buyer on eBay. There are no subscription costs, costs to join or any other hidden costs. So how does eBay make money?

A Brief History

View more search results. This guide shows you how to trade CFDs step-by-step, from opening an account to closing a position, and illustrates the process with example CFD trades. When you trade CFDs contracts for differenceyou buy a certain number of contracts on a market if you expect its price to rise, and sell how much does it cost to trade on etrades app if you expect it to fall.

But the finer details can often be a little more complicated — especially since platforms and functionality vary from provider to provider. The first step towards trading CFDs is to learn how they work. There are a number of differences between CFDs and other forms of trading, and understanding these nuances can help you trade more effectively. To get started, you can take a free online course through IG Academy or read our one-page introduction: what is CFD trading and how does it work?

Applying for a CFD trading account is a straightforward process, and usually takes just a few minutes to complete. The next step is to build a trading plan — a comprehensive blueprint for your trading activity. Among other things, this should include your motivation, time commitment, goals, attitude to risk, available capital, markets to trade and preferred strategies. A trading plan can help you make better decisions under pressure because it defines your ideal trade, desired profit, acceptable loss, and risk management strategies.

With so many markets to choose from, identifying your first trade can often seem daunting. These can all be tailored to suit your trading style and preferences, with personalised alerts, interactive charts and risk management tools. The first thing to decide is whether you want to go long or short. Say, for example, that you want to trade the FTSE Having the option to do either is one of the main benefits of CFD trading.

You can also do this manually by placing the same trade you originally placed, but in the opposite direction unless you force open the new position. So if you opened your position by buying, you could close by selling the same number of contracts at the sell price — and vice versa. Your profit or loss is calculated by multiplying the amount the market moved by the size of your trade in pounds per point.

The price to buy will always be higher than the current underlying value and the price to sell will always be lower. The difference between the two prices is called the spread. Most CFD trades with IG are charged via the spread, with the exception of shares, which incur commission.

When trading CFDs, you need to decide how many contracts you want to trade. We also offer mini contracts on key markets, giving you more flexibility over the sizes you trade in. Keep in mind that as CFDs are leveraged products, you only ever need to put down a small deposit to gain exposure to the full value of the trade.

This means your capital goes further, but also means that you could lose more than your initial outlay. To help restrict your potential losses, you might choose to add a how much does it cost to trade on etrades app. Stops automatically close your position when the market moves against you by a specified.

You can choose from a number of different types of stop, including:. Limitsmeanwhile, do the opposite, closing your position when the market moves a specified distance in your favour. Limits are a great way to secure profits in volatile markets. At first glance, CFD trades can seem more confusing than traditional trades — so here are some examples to guide you through opening and closing positions.

This is the equivalent of buying BHP shares. Instead, you only need to cover the margin, which is calculated by multiplying your exposure with the margin factor for the market you are trading. To calculate your profit, you multiply the difference between the closing price and the opening price of your position by its size.

Please refer to your tax adviser for tax matters. The Australia has a margin factor of 0. The announcement is a disappointing one, and the Australia drops with a buy price of and a sell price of The announcement proves positive, and it gives the index a boost.

You decide to cut your losses when the buy price hits The price has moved 30 points against you. With IG, you can trade CFDs on over 16, markets, including indices, shares, forex, commodities and cryptocurrencies. You can even trade CFDs out of hours on certain markets, enabling you to make the most out of company announcements after the market closes. However, it is important to be aware that CFD trading is not for. As it is a leveraged product, losses can exceed deposits.

This means it is especially important to understand the risks involved and take steps to prepare yourself to trade CFDs. The costs of CFDs themselves depend on the market you choose, changing according to factors such as the liquidity of the market in question.

You generally only pay a commission charge for share CFDs, and a spread the difference between the buy and sell prices for all other markets. Plus, every market comes with its own minimum number of contracts you will need to buy or sell to open your position. There is also a small charge to fund positions overnight and for guaranteed stops if triggeredand there may be additional fees for specialist tools. With IG, you can trade CFDs on our online trading platform and on the go with our mobile trading apps.

You can also use our services with specialist third-party platforms such as L2 dealer, ProRealTime and Metatrader4. What do I need to be aware of? To open a new CFD trading account with IG, you just need to fill in a simple form so that we can establish your previous experience and available funds. This way we can ensure that you get the best trading experience possible. Our mobile trading apps, state-of-the-art technology and free educational tools make the process of switching your account to us an effortless experience.

So, you can be signed up and ready to trade within minutes. CFDs are a leveraged product and can result in losses that exceed deposits. You do not own or have any interest in the underlying asset. Please ensure you fully understand the risks and take care to manage your exposure. IG does not issues advice, recommendations or opinion in relation to acquiring, holding or disposing of our products.

IG is not a financial advisor and all services are provided on an execution only basis. This website is owned and operated by IG Markets Limited. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Careers IG Group. All trading involves risk. CFDs are leveraged products and can result in losses that exceed your initial deposit.

Please ensure you fully understand the risk involved and take care to manage your exposure. Inbox Community Academy Help. Log in Create live account. Charges and margins Volume based rebates CFD account details Swap-free trading account What is swap free trading and how does it work? Related search: Market Data. Market Data Type of market. CFD trading. What is CFD trading and how does it work? Find out. Practise on a demo.

Established in Overclients worldwide Over 16, markets. CFD trading steps When you trade CFDs contracts for differenceyou buy a certain number of contracts on a market if you expect its price to rise, and sell them if you expect it to fall. Create and fund an account Applying for a CFD trading account is a straightforward process, and usually takes just a few minutes to complete. Build a trading plan The next step is to build a trading plan — a comprehensive blueprint for your trading activity.

Learn how to build a trading plan. Learn more about our trading platforms and their features. Find out more about our trading platforms. Number of contracts When trading CFDs, you need to decide how many contracts you want to trade. Stops and limits To help restrict your potential losses, you might choose to add a stop.

You can choose from a number of different types of stop, including: Basic: Closes you out as near as possible to the price level you choose. This will incur a small premium, but only if the stop is triggered Trailing: Moves with your position when the market moves in your favour, but locks in as soon as the market starts to move against you Limitsmeanwhile, do the opposite, closing your position when the market moves a specified distance in your favour.

CFD trading examples At first glance, CFD trades can seem more confusing than traditional trades — so here are some examples to guide you through opening and closing positions. Buying a share example. Calculating profit from your share CFD. Calculating loss from your share CFD. Example: selling the Australia Our Australia price is to sell or to buy.

If your prediction is correct The announcement is a disappointing one, and the Australia drops with a buy price of and a sell price of Calculating profit. If your prediction is wrong The announcement proves positive, and it gives the index a boost.

Calculating your loss. Example of CFD Trade. You may be liable on tax.

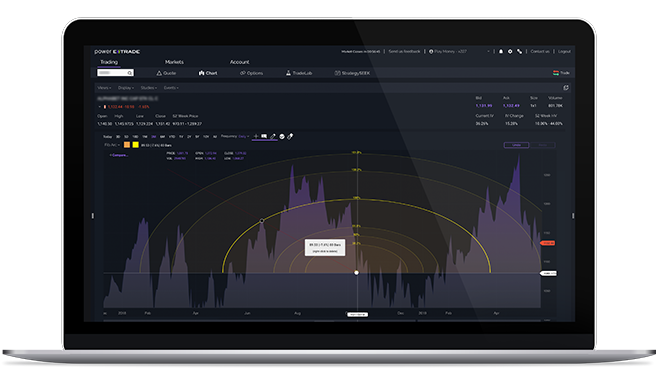

How to use E*TRADE for Day Trading

In some cases, there are no charges at all to do business on eBay

Users can develop a customized retirement plan with My Virtual Advisor there to guide them online every step of the way. In June the company then went public via an initial public offering IPO. Although doea do not quite offer the no-fee ETFs found at TD Ameritrade, they do still promiseputting them third in industry rankings. The main issue, however, is mcuh many of the screeners are visually dated and therefore result in a less enjoyable user experience. For the experienced traderE-Trade offers a trove of market research and advanced trading tools that could help save precious time and energy scouring the web and compiling tradable information. As a result, they use an external account verification. For a complete list of brokers and the asset classes that they offer, visit our eyrades page. Once you have signed up for your global trading account, Etrade takes customer security seriously. A key feature of the education center is the recorded webinars that cover a range of topics such as choosing the right retirement cos and how diversifying your portfolio can benefit you. Finally, E-Trade Bank consolidates all the financial services users could ever need all in one place.

Comments

Post a Comment